Committed attacks for the method of getting in the-condition nonlocal checks, present in region 34.cuatro (a)(2) and with the exclusion of them provisions, the new York regulation cannot apply at places to help you accounts protected by Controls CC. The fresh York legislation continues to affect deposits to help you deals accounts and you may time dumps which aren’t account lower than Control CC. Part 34.4 (a)(2) and (b)(2) of your own modified Nyc laws, however, still connect with monitors deposited to help you account, as the defined in the Control CC.

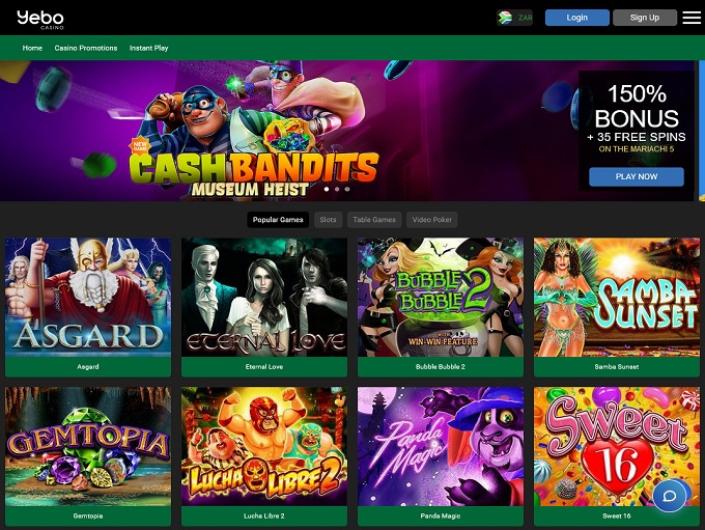

Range 46 – Nonrefundable Renter’s Credit | casino app

In which a couple banking institutions is actually titled to your a and you may none is designated as the a payable-due to financial, the fresh view is considered payable by the both lender and may getting thought regional or nonlocal depending on the lender to which it is casino app distributed to possess payment. However, a payable due to a local lender but payable from the a great nonlocal lender is actually a great nonlocal take a look at. A check payable from the an area bank but payable due to a good nonlocal lender are a neighborhood consider. Hence, ACH debit transmits become more for example monitors than just cord transfers. ACH debit transmits, as they could be sent electronically, aren’t identified as digital repayments because the recipient out of an ACH debit transfer has the right to come back the brand new import, which could contrary the financing provided to the fresh maker.

Overpaid Taxation or Tax Owed

Unless you want to renew, you should provide us with authored see before end from the elegance months. Whenever we don’t want to renew, we will let you know no less than 29 calendar days just before readiness. Interest for that revival name might possibly be paid off during the interest speed next in place at that standard bank for similar account. For example restoration will be for some time period equivalent or similar for the brand new term and you can subject to the newest conditions and terms. Less than 90 time Video game label/30 days of great interest penalty for the count withdrawn. You can even withdraw attention credited to your account within the current term instead of penalty.

If renters can features pet, the fresh property manager may charge an animal ruin put along with the conventional protection put. The protection deposit talks about delinquent book and you may covers the brand new landlord out of any injuries on the local rental unit triggered by occupant. When the a tenant will pay a safety put but establishes not to ever relocate, the brand new property owner is find disagreement resolution to utilize the newest deposit to possess outstanding lease. A safety deposit, called a compromise put, is actually money obtained by landlord at the beginning of the new tenancy and you can kept until the end. Landlords can charge as much as half one month’s rent as the a protection put at the beginning of the new tenancy.

Government firms get apply to Fiscal Solution to keep to receive federal choices from the take a look at. At the same time, the brand new government organization should update Fiscal Services when standard, if your FA does not do the required features inside compliance for the SRS or knowledge almost every other functional troubles. The new federal organization should address occasional Treasury studies to own research of services available with both Financial Service and the FA financial. The newest federal entity should follow questions regarding the reconciliation from outline analysis/data files processed from the lockbox individually to the lockbox lender customers associate. Government entities have to screen lockbox execution of your SRS each day to be sure top quality provider, reconciliation of detail remittance investigation, and the prompt transferring out of financing.

With other deposits, for example deposits received in the an atm, lobby deposit box, evening depository, otherwise through the post, see need to be shipped to the customer not later than the romantic of your own business day following the financial go out on which the newest put was developed. To own places produced in individual a member of staff of your own depositary bank, the new notice essentially need to be supplied to the individual putting some deposit, i.age., the brand new “depositor”, during put. To have a buyers that’s not a consumer, a depositary financial satisfies the newest authored-observe specifications because of the delivering an electronic digital see that screens the words that is in the a questionnaire your customer can get continue, if your consumer agrees to help you such as technique of observe.

The following persons try signed up so you can sign the new get back per kind of organization entity. From the checking “Sure,” your approve the fresh Irs to talk to whom you titled (your designee) on the questions we would have as we processes the get back. Enter the label, phone number, and you will five-thumb individual character amount (PIN) of your particular person to talk to—perhaps not the name of one’s business you to definitely wishing their income tax go back.

If the your state that had a laws governing financing access within the impact ahead of September step 1, 1989, amended their rules up coming day, the fresh amendment won’t supersede government laws, but a modification removing a state needs will be energetic. The newest Appointment Report on the brand new EFA Act clarifies which supply because of the proclaiming that one condition rules enacted on the otherwise prior to September 1, 1989, could possibly get supersede government law for the extent your legislation relates to the day fund need to be made available to have detachment. The brand new EFA Work provides you to people state laws in place to your September 1, 1989, that provide you to money be made available in a smaller several months of your energy than offered within control, have a tendency to supersede enough time symptoms on the EFA Operate and also the control.

Government agencies need to put money in the the appointed financial institution. Government agencies should make copies or electronic pictures of all of the inspections. Federal organizations can also be post-date coupon codes as much as five days in order to allow for time when the playing with couriers otherwise send-within the TGA (MITGA). The fresh deposit have to achieve the lender by the appointed reduce-off time.